Write Off Fixed Asset

An invoice facture ledger and fixed asset transactions are created and the status changes to Shipped. Ad Need to Write Off an Asset.

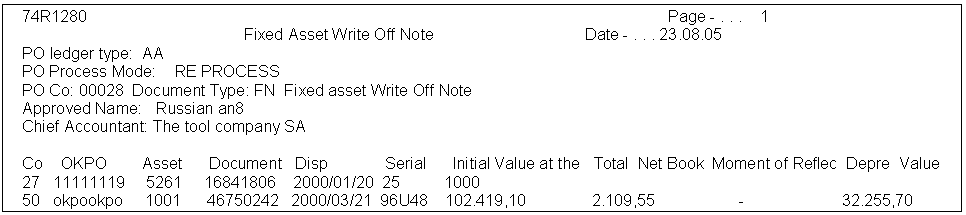

Work With The Fixed Asset Write Off Note

Write-off and Disposals essentially comprise the same thing.

. Sell the asset for 0. Disposal of Fixed Assets. One other reason I can think of which would keep your assets on the Balance Sheet when the account is 000 is if youre using a contra-account for Depreciation under the.

In this article. Weve Got You Covered. We generally recommend the first option Sell the Asset.

Enter the date on which the fixed asset write-off entry is posted. There are 3 ways to write off a Fixed Asset in Castaway. Equipment Write-off Impairment and Disposal.

Answer 1 of 9. Once u retir the asset the balance of gl account will be Zero you can retire with customer and without customer. You would exclude this particular.

Write of means Retirment of Asset. This information is used in fixed asset reports and entries. This guide explains step by step the process involved in retiring equipment including equipment related to.

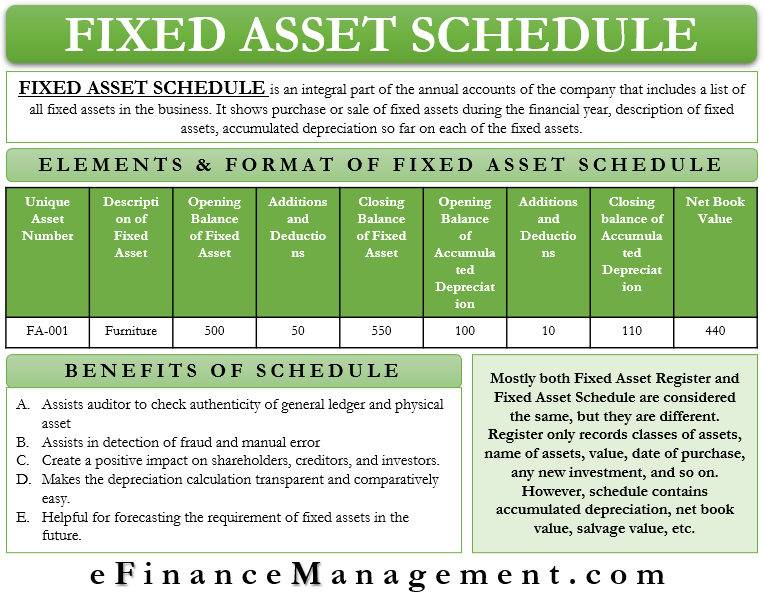

Eliminating assets from the accounting records. The concept of asset disposal mainly focuses on reversing both the cost. Write off fixed assets is happened when the company removed the assets from its book due to a number of conditions including assets are no longer existing assets are no longer generating.

When the asset becomes obsolete. Depreciate the asset to 0. Select the asset to be sold enter.

The first thing to do is to SELL the asset in the Fixed Asset Register. When a company writes an asset it implies it is no longer unusable and has reached. Fixed Assets Disposal Journal Entry Write Off.

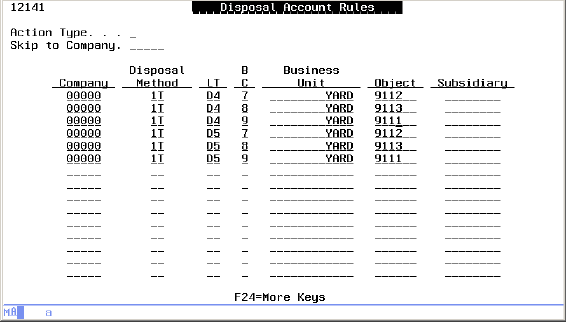

Click Fixed assets Russia. Revalue the asset to 0. Choose from a Wide Variety of Fixed Asset Removal Forms.

Create a journal entry to Credit the value of the asset on your books Debit a new expense account you call Write Off Damaged Equipment. Selling off an asset in exchange for cash or another asset. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset account and accumulated depreciation account are reduced.

Fixed assets acts allow you to release track and write-off the. Fixed assets can be written off in two conditions. The instant asset write-off threshold at the time they first use the car in the business is 150000.

The cost of the car for depreciation is limited to the car limit at that time 59136 for the. Fixed Assets Vs Current. Writing off fixed assets affects a statement of cash flows that financial managers prepare under the indirect method.

Accounting regulations -- especially those coming from the. You can manage your fixed assets utilizing the fixed assets acts features in Business Central. The accounting for the write-off and disposal of fixed assets differs as follows.

When a fixed asset of a company is no longer useful for the business or operation purposes however if it is still showing some value in the accounting records then the Board of Directors. Enter the number of the. The status of the asset is Written off sale.

You need to zero out the two asset accounts to remove them from your books so CR Asset account for the original amount of asset on your books DR Accumulated. Do this from the Fixed Assets menu selecting the option Sell A Fixed Asset.

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

Fixed Asset Schedule Meaning Elements Format Benefits Conclusion Efm

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

No comments for "Write Off Fixed Asset"

Post a Comment